Human Resources recently held the second session of its increasingly popular “The Roadmap to Retirement — Planning and Process Overview” education program, and additional sessions are coming.

The benefits office recently began offering retirement information programs designed for employees within five years of retirement. The sessions offer a chance to learn more about retirement preparation from Ernie Pressman, retirement plan administrator, and Cindi Peterson, benefits manager.

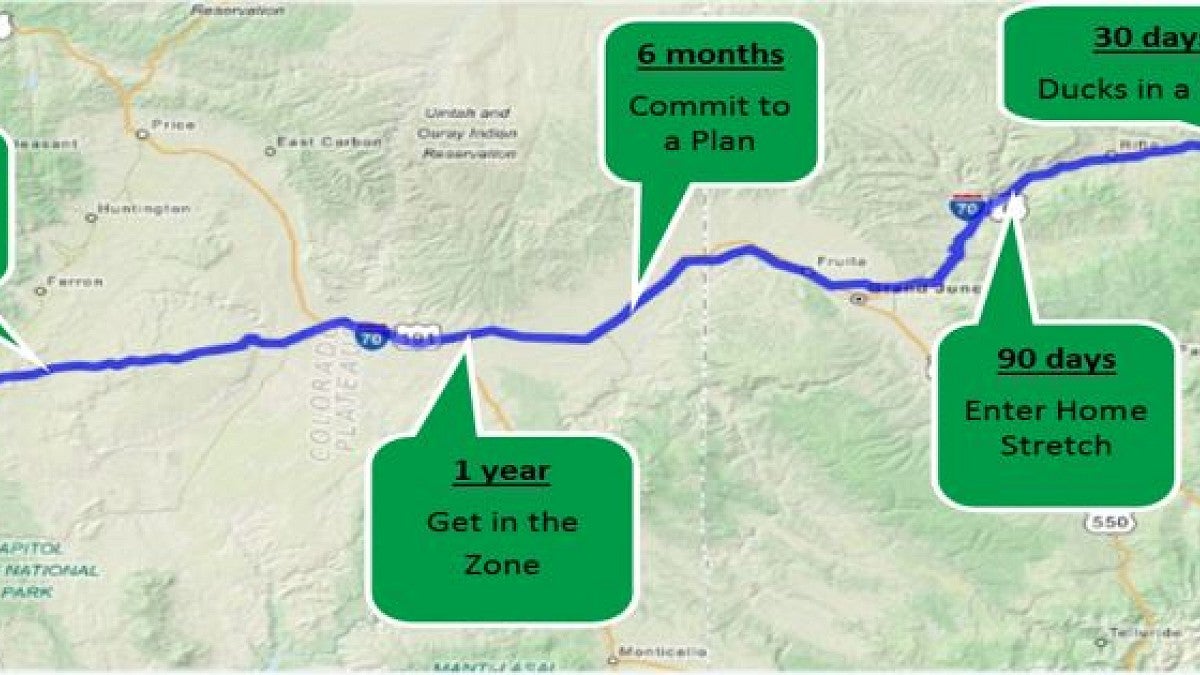

The key topics discussed are: identifying your retirement plan and eligibility, setting a realistic retirement date, creating a financial plan for retirement, and reviewing the available resources for ongoing planning and preparation.

“Our goal is to demystify the retirement planning process so employees feel prepared rather than overwhelmed,” Pressman said.

Although retirement can be a complicated process, Peterson stressed that a number of resources are available to employees to plan and prepare for retirement.

“In addition to the education seminars, the benefits office has centralized key retirement planning resources to support and empower employees no matter where they are in the process,” Peterson said.

The benefits office launched a new Retirement Planning Guide and Resources Web page that includes key components of the planning process, such as a retirement checklist and a budget worksheet. It also includes important resources that provide a central reference point throughout the retirement planning process, including a forms library and important links to PERS, Social Security and healthcare and insurance options.

The benefits office will continue offering regular education programs. The next retirement planning overview session is set for Sept. 30, and the next “PERS Application Assistance: How to Complete and When to File” seminar is Oct. 21.

Visit the Education page of the Web-based Retirement Planning Guide and Resources for a listing of upcoming programs.

A recent participant stated that the seminar and the Web page made her feel much more comfortable about starting the process and that the resources are really helpful.

More education sessions are also being planned by the benefits office, including special sessions with presenters from TIAA-CREF, Fidelity and Valic.